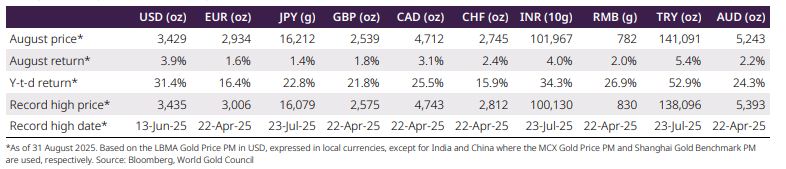

New Delhi [India], September 7 (ANI): Gold, internationally, continued its stellar run in August 2025, closing the month at USD 3,429 per ounce, marking a 3.9 per cent monthly gain, and taking its year-to-date rise to 31.4 per cent, according to the World Gold Council’s latest commentary.

The yellow metal is now hovering just shy of its all-time high of USD 3,435 per ounce, reached earlier in June 2025, according to the latest Gold Market Commentary by WGC.

The gold rally was observed in August due to a weak US dollar, strong inflows into gold-backed ETFs, and persistent geopolitical tensions.

“…major contributors to August price performance were a drop in the US dollar early in the month, continued geopolitical tensions, and strong global gold ETF flows. More recently, a higher chance of a September rate cut has also played a role,” the WGC report read.

Inflows into global ETFs totalled USD 5.5 billion in August, with North America and Europe leading the charge, while Asia and other markets saw outflows.

“Global gold ETFs saw their third consecutive inflows in August, once again led by Western funds,” the report added.

Continued equity strength, with the CSI300 Stock Index jumping 10 per cent in August, kept diverting local investors in China away from gold, the WGC asserted.

In contrast, India saw its fourth consecutive monthly inflow in August, supported by elevated safe-haven needs amid weak equities as well as ongoing global trade and geopolitical risks. “But they were insufficient to offset Chinese outflows,” WGC said.

In India, one of the world’s largest gold consumers, the price momentum was robust in August and year-to-date 2025.

Prices on the Multi Commodity Exchange of India (MCX) hit Rs 101,967 per 10 grams, a 4 per cent gain in August and an impressive 34.3 per cent jump since the start of the year 2025, the WGC report showed.

India’s market performance outpaced many peers, in a way, reflecting robust investment demand and a steady domestic appetite at high price levels.

Looking forward, US stagflationary forces and the prospect of lower rates, alongside policy risk, could dominate prices as emerging market demand takes a breather. (ANI)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages